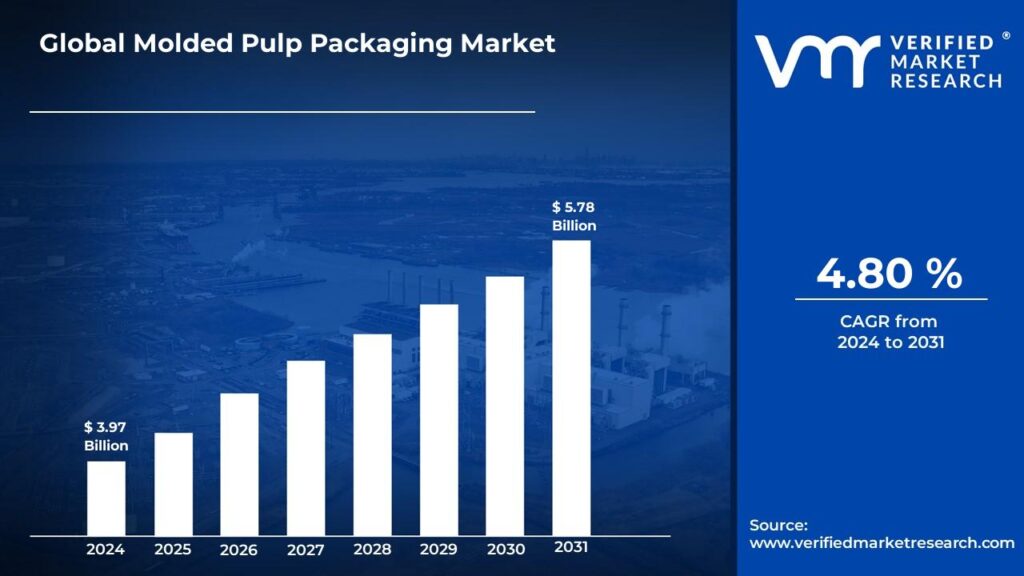

Molded Pulp Packaging Market is expected to generate a revenue of USD 5.78 Billion by 2031, Globally, at 4.80% CAGR: Verified Market Research®

The global Molded Pulp Packaging Market is witnessing robust growth due to the surging demand for eco-friendly and biodegradable packaging solutions. Increasing environmental awareness, stringent government regulations on plastic usage, and rising adoption in food & beverage and consumer goods sectors are fueling market expansion. However, the high production cost and limited material flexibility may slightly restrain growth potential.

Lewes, Delaware, Nov. 13, 2025 (GLOBE NEWSWIRE) -- The Global Molded Pulp Packaging Market Size projected to grow at a CAGR of 4.80% from 2024 to 2031, according to a new report published by Verified Market Research®. The report reveals that the market was valued at USD 3.97 Billion in 2024 and expected to reach USD 5.78 Billion by the end of the forecast period.

For a detailed analysis of Industry Trends And Growth Drivers, Explore The Full Molded Pulp Packaging Market.

For a detailed analysis of Industry Trends And Growth Drivers, Explore The Full Molded Pulp Packaging Market.

Browse in-depth TOC

202 - Pages

126 – Tables

37 – Figures

Global Molded Pulp Packaging Market Overview

Market Driver

1. Rising Demand for Sustainable and Eco-Friendly Packaging Solutions

The global transition toward sustainable business practices is driving the growth of the Molded Pulp Packaging Market. Organizations across multiple industries are reducing their dependence on single-use plastics and shifting to biodegradable packaging materials. Molded pulp packaging stands out due to its recyclability, compostability, and cost-effectiveness compared to petroleum-based plastics.

- Increasing environmental awareness among consumers and industries is accelerating adoption.

- Global brands are integrating molded pulp into their packaging strategies to strengthen ESG commitments.

- Governments and regulatory bodies are enforcing eco-compliance norms, creating strong market incentives.

- Businesses view molded pulp as a key differentiator for achieving sustainability targets and brand loyalty.

- This growing demand underscores a significant market opportunity for manufacturers and suppliers offering eco-friendly packaging innovations that align with circular economy principles and attract environmentally conscious consumers.

2. Expanding Applications in Food and Beverage Industry

The food and beverage (F&B) sector has emerged as a dominant end-user segment for molded pulp packaging. As sustainability becomes a central purchasing factor, restaurants, cafes, and QSRs are switching from plastic and Styrofoam packaging to molded pulp alternatives. The material’s natural cushioning, insulation, and hygiene properties make it ideal for packaging eggs, beverages, and takeaway food items.

- Molded pulp trays, cups, and containers provide safe handling and eco-friendly disposal.

- The growth of food delivery services and online food platforms increases demand for lightweight, sustainable packaging.

- Compliance with food safety standards and sustainability certifications enhances adoption rates.

- F&B brands leverage molded pulp packaging to enhance green branding and attract eco-conscious consumers.

- This expanding application base strengthens market penetration and creates long-term opportunities for packaging producers to collaborate with major F&B chains and food delivery companies on sustainable product innovations.

3. Government Regulations and Ban on Single-Use Plastics

Global environmental regulations are acting as a strong catalyst for the molded pulp packaging industry. Governments across North America, Europe, and Asia-Pacific are enforcing strict bans on single-use plastics, driving industries to adopt recyclable and biodegradable packaging alternatives. Molded pulp packaging fulfills these requirements without compromising on strength or functionality.

- Policy measures, such as Extended Producer Responsibility (EPR) programs, encourage the use of sustainable materials.

- Businesses face growing pressure to comply with green packaging mandates and emission reduction goals.

- Corporate sustainability initiatives are aligning with regulatory frameworks to ensure compliance and public accountability.

- Investments in molded pulp molding technologies are rising as companies seek long-term eco-compliant packaging solutions.

- This regulatory landscape not only boosts molded pulp demand but also provides a competitive edge to manufacturers that prioritize compliance, environmental responsibility, and product innovation.

Download a free sample to access exclusive Insights, Data Charts, And Forecasts From The Molded Pulp Packaging Market Sample Report

Download a free sample to access exclusive Insights, Data Charts, And Forecasts From The Molded Pulp Packaging Market Sample Report

Market Restraints

1. High Production Costs and Capital Investment

While molded pulp packaging presents numerous sustainability benefits, its high initial setup and operating costs remain major challenges for manufacturers. The process involves specialized equipment, drying systems, and tooling, which demand significant upfront investment.

- Small and medium enterprises (SMEs) often face financial constraints in adopting advanced pulp molding technologies.

- Raw material price fluctuations, especially recycled paper and fibers, affect production economics.

- Energy-intensive manufacturing processes further increase operational costs and limit scalability.

- Market players need to implement cost-optimization strategies to maintain profitability and competitiveness.

- These financial barriers restrict new entrants from exploring full-scale production, prompting investors and stakeholders to carefully evaluate ROI models before committing to long-term expansion plans.

2. Limited Barrier Properties and Design Flexibility

Molded pulp packaging offers excellent sustainability benefits but has technical limitations in barrier protection and design versatility. Unlike plastic, it provides lower resistance to moisture, oils, and gases, which restricts its suitability for packaging sensitive or high-value products.

- Industries like pharmaceuticals and electronics require higher barrier performance, limiting molded pulp use.

- Aesthetic limitations and uneven texture can affect visual appeal for premium product packaging.

- Manufacturers must invest in coating technologies and hybrid material designs to improve durability.

- Limited design customization capabilities reduce flexibility in branding and consumer engagement.

- Overcoming these constraints requires technological innovation and R&D investments to enhance the functionality, strength, and visual appeal of molded pulp products while maintaining their environmental integrity.

3. Supply Chain Challenges and Raw Material Dependency

The molded pulp packaging market heavily relies on the availability of raw materials such as recycled paper, cardboard, and agricultural waste fibers. Regional inconsistencies in recycling infrastructure and material collection pose significant supply chain challenges.

- Uneven access to high-quality recycled paper affects production consistency and product quality.

- Logistics inefficiencies in transporting bulky molded pulp items increase overall distribution costs.

- Emerging economies face difficulties in establishing robust waste management systems for steady raw material flow.

- Manufacturers need to develop localized sourcing strategies and improve recycling networks to stabilize supply.

- These supply chain constraints can hamper scalability and market growth, especially in developing regions. Strategic investments in recycling technology and regional material sourcing are essential to strengthen supply stability and ensure long-term competitiveness.

Geographical Dominance: North America dominates the Molded Pulp Packaging Market due to stringent environmental regulations, strong recycling infrastructure, and increasing adoption of sustainable packaging by major food and beverage brands. Europe closely follows with rising consumer preference for eco-friendly materials and strict EU waste reduction policies. Meanwhile, Asia-Pacific is emerging as the fastest-growing region, driven by rapid industrialization, expanding e-commerce, and government initiatives promoting biodegradable packaging solutions in key markets such as China, India, and Japan.

Key Players

The “Global Molded Pulp Packaging Market” study report will provide a valuable insight with an emphasis on the global market. The major players in the market are Brødrene Hartmann A/S, UFP Technologies, Thermoformed engineered Quality (TEQ) LLC, Genpak LLC and Eco-Products, Pro-Pac Packaging, PrimeWare-by PrimeLink Solutions, Fabri-Kal, Henry Molded Products, EnviroPAK Corporation, Pacific Pulp Molded, Sabert Corporation, Protopak Engineering Corporation and Cellulose de la Loire.

Molded Pulp Packaging Market Segment Analysis

Based on the research, Verified Market Research has segmented the global market into Source, Product, End-User, and Geography.

-

Molded Pulp Packaging Market, by Source

- Wood Pulp

- Non-wood Pulp

-

Molded Pulp Packaging Market, by Product

- Trays

- End Caps

- Bowls & Cups

- Clamshells

-

Molded Pulp Packaging Market, by End-User

- Food Packaging

- Food Service

- Electronics

- Healthcare

-

Molded Pulp Packaging Market, by Geography

-

North America

- U.S

- Canada

- Mexico

-

Europe

- Germany

- France

- U.K

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

ROW

- Middle East & Africa

- Latin America

-

North America

Strategic Insight:

The Molded Pulp Packaging Market is witnessing strong growth driven by sustainability trends, government regulations, and expanding applications across the food and beverage sector. However, high production costs, limited design flexibility, and supply chain inefficiencies pose challenges. North America and Europe lead due to strict eco-compliance norms, while Asia-Pacific offers lucrative growth opportunities through industrial expansion and green initiatives. Businesses entering this market should focus on cost optimization, material innovation, and regional partnerships to gain a competitive edge and capitalize on the rising demand for eco-friendly, recyclable, and biodegradable packaging solutions.

To gain complete access with Corporate Or Enterprise Licensing, Visit The Molded Pulp Packaging Market.

Key Highlights of the Report:

- Market Size & Forecast: In-depth analysis of current value and future projections

- Segment Analysis: Breaks down the market by Source, Product, and End-User for focused strategy development.

- Regional Insights: Comprehensive coverage of North America, Europe, Asia-Pacific, and more

- Competitive Landscape: Profiles key players, their strategic initiatives, and innovation-driven growth approaches.

- Growth Drivers & Challenges: Analyzes the forces accelerating growth and the restraints hindering large-scale adoption.

- Challenges and Risk Assessment: Evaluates ethical debates, off-target effects, and regulatory complexities.

Why This Report Matters?

This report provides actionable insights and verified data to help businesses make informed strategic decisions. It enables market players to identify new growth avenues, optimize product portfolios, and strengthen their sustainability positioning in the global packaging industry.

Who Should Read This Report?

This report is essential for packaging manufacturers, sustainability managers, business strategists, investors, R&D professionals, and policymakers looking to capitalize on the expanding molded pulp packaging market and stay ahead in the evolving eco-packaging landscape.

Browse Related Reports:

Global Contract Packaging Market Size By Packaging (Primary, Secondary), By End-User Industry (Food, Beverage), By Geographic Scope and Forecast

Global Dairy Packaging Market Size By Product Type (Liquid Dairy Products, Yogurt Packaging), By Material (Plastic, Glass), By Packaging Type (Bags & Pouches, Boxes), By Geographic Scope And Forecast

Global Consumer Packaged Goods (CPG) Market Size By Food and Beverage (Beverages, Packaged Foods), By Personal Care and Household Products (Personal Care Products, Household Products), By Health and Wellness Products (Nutritional Supplements, Functional Foods), By Geographic Scope And Forecast

Global Consumer Goods Contract Packaging Market Size By Product Type (Food and Beverages, Personal Care Products, Pharmaceuticals, Cosmetics), By Packaging Type (Flexible, Rigid, Secondary), By Material (Plastic, Metal, Biodegradable Materials), By End-User Industry (Food Service, Healthcare, Electronics), By Geographic Scope And Forecast

5 Leading Molded Pulp Packaging Companies maintaining goodness inside Visualize Molded Pulp

Packaging Market using Verified Market Intelligence -:

Verified Market Intelligence is our BI Enabled Platform for narrative storytelling in this market. VMI offers in-depth forecasted trends and accurate Insights on over 20,000+ emerging & niche markets, helping you make critical revenue-impacting decisions for a brilliant future.

VMI provides a holistic overview and global competitive landscape with respect to Region, Country, Segment, and Key players of your market. Present your Market Report & findings with an inbuilt presentation feature saving over 70% of your time and resources for Investor, Sales & Marketing, R&D, and Product Development pitches. VMI enables data delivery In Excel and Interactive PDF formats with over 15+ Key Market Indicators for your market.

About Us

Verified Market Research® stands at the forefront as a global leader in Research and Consulting, offering unparalleled analytical research solutions that empower organizations with the insights needed for critical business decisions. Celebrating 10+ years of service, VMR has been instrumental in providing founders and companies with precise, up-to-date research data.

With a team of 500+ Analysts and subject matter experts, VMR leverages internationally recognized research methodologies for data collection and analyses, covering over 15,000 high impact and niche markets. This robust team ensures data integrity and offers insights that are both informative and actionable, tailored to the strategic needs of businesses across various industries.

VMR's domain expertise is recognized across 14 key industries, including Semiconductor & Electronics, Healthcare & Pharmaceuticals, Energy, Technology, Automobiles, Defense, Mining, Manufacturing, Retail, and Agriculture & Food. In-depth market analysis cover over 52 countries, with advanced data collection methods and sophisticated research techniques being utilized. This approach allows for actionable insights to be furnished by seasoned analysts, equipping clients with the essential knowledge necessary for critical revenue decisions across these varied and vital industries.

Verified Market Research® is also a member of ESOMAR, an organization renowned for setting the benchmark in ethical and professional standards in market research. This affiliation highlights VMR's dedication to conducting research with integrity and reliability, ensuring that the insights offered are not only valuable but also ethically sourced and respected worldwide.

Follow Us On: LinkedIn | Twitter | Threads | Instagram | Facebook

Mr. Edwyne Fernandes Verified Market Research® US: +1 (650)-781-4080 US Toll Free: +1 (800)-782-1768 Email: sales@verifiedmarketresearch.com Web: https://www.verifiedmarketresearch.com/ SOURCE – Verified Market Research®

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.